salt tax deduction limit

The first is the new 10000 limitation on deducting state and local taxes also called SALT on your federal income tax return. The new proposal from the Democrats raises.

Salt Deduction Should I Deduct My State And Local Income Or Sales Tax Archer Tax Solutions Llc

This significantly increases the boundary that put a cap on the SALT.

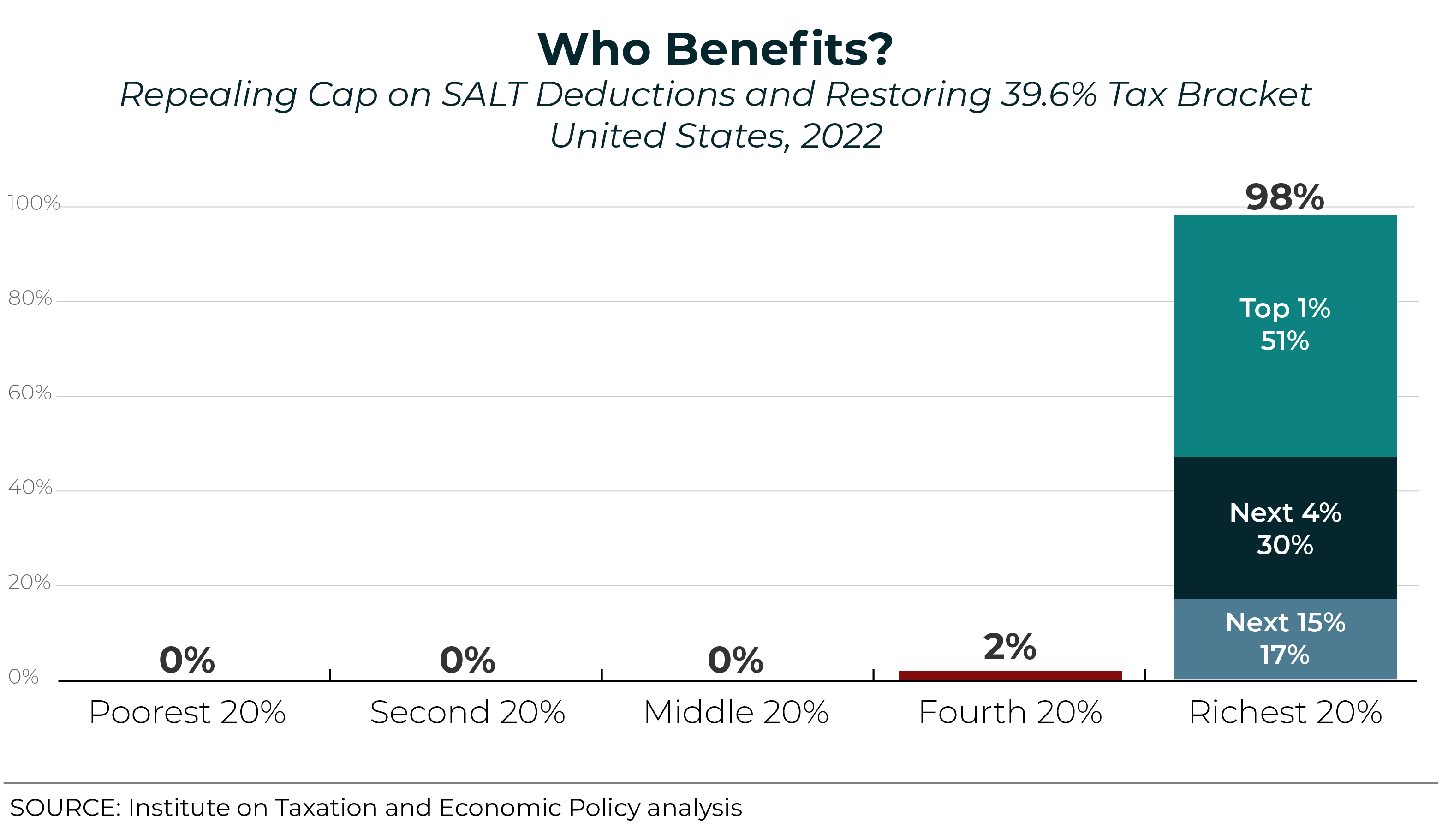

. The SALT deduction is a federal tax deduction that allows some taxpayers to deduct the money they spend on state and local taxes. The SALT deduction benefits the high-income earners the most. Starting in 2021 through 2030 the SALT deduction limit is increased to 80000.

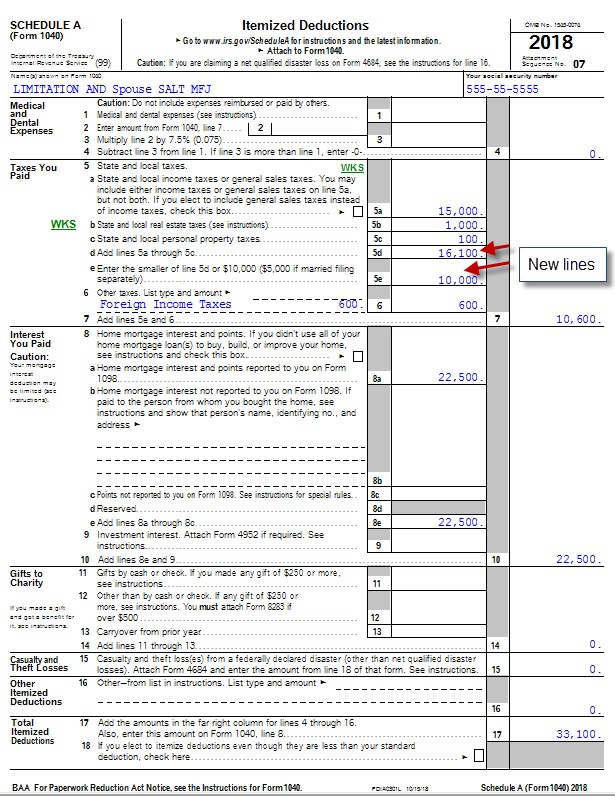

The Tax Cuts and Jobs Act imposed a 10000 limit on the SALT deduction so regardless of how much you actually pay in state and local taxes youre only allowed to deduct. The Tax Cuts and Jobs Act. If you paid 5000 in state taxes then you can deduct the full 5000 of state taxes paid on your federal return as an itemized deduction.

New limits for SALT tax write off. There is talk that the SALT deduction limit will be. In urging repeal of the 10000 cap on the deduction for state and local taxes SALT Rep.

22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return. To be impacted by the limit 3. Second is New Jerseys longstanding 10000 cap on deducting.

What is the SALT deduction limit. The 10000 limit on SALT. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments.

This will leave some high-income. 52 rows The state and local tax deduction commonly called the SALT. The SALT Tax deduction limit or cap was set at 10000 dollars in 2017 but this was set to expire in 2026 and become uncapped.

After fighting to repeal the 10000 limit on the federal deduction for state and local taxes known as SALT a group of House Democrats say theyll vote for the. The change may be significant for filers who itemize deductions in. House Democrats spending package raises the SALT deduction limit to 80000 through 2030.

The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns. Second the 2017 law capped the SALT deduction at 10000 5000 if. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a.

The SALT deduction benefits only a shrinking minority of taxpayers. The federal government enacted a. But you must itemize in order to deduct state and local taxes on your federal income tax return.

The Tax Cuts and Jobs Act of 2017 placed a 10000 cap on State and Local Tax SALT deductions. The Tax Cuts and Jobs Act TCJA limited the amount an individual can deduct from the amount of the following state and local taxes they. The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018.

The federal tax reform law passed on Dec. Previously the deduction was unlimited. Prior to the change in 2017 about 77 of taxpayers with an adjusted gross income of 100000 or more.

Salt Is A Wound Both Sides Of The Aisle Upset With Tax Deduction Plan In Bbb Act Pittsburgh Post Gazette

How Does The Deduction For State And Local Taxes Work Tax Policy Center

House Democrats Push For Salt Relief In Appropriations Bill

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

Salt Deduction Limits And Pass Through Entities Dallas Business Income Tax Services

California Proposes State And Local Tax Cap Workaround

New Limits On State And Local Tax Deductions Williams Keepers Llc

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

S Corp Workaround For Salt Deduction Cap Wcre

Possible Federal Tax Law Changes On The Horizon

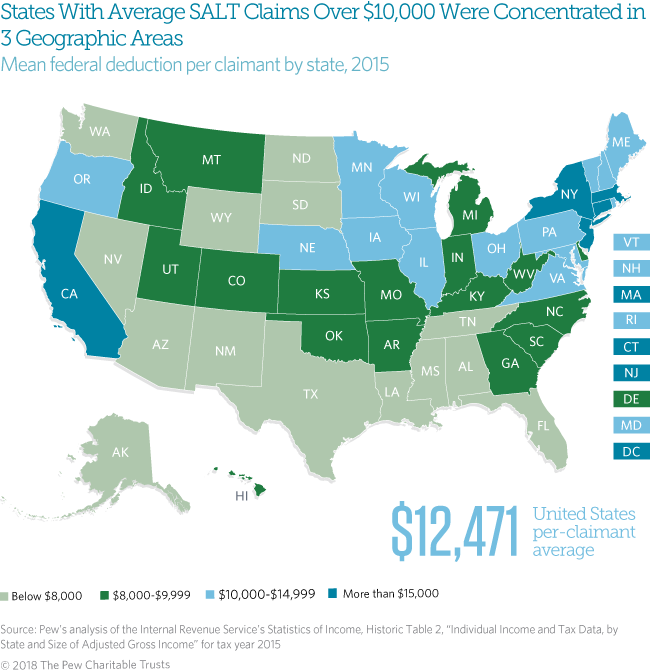

Cap On The State And Local Tax Deduction Likely To Affect States Beyond New York And California The Pew Charitable Trusts

How Tax Reform Affects The State And Local Tax Salt Deduction Tax Pro Center Intuit

Vacation Home Rentals And The Tcja Journal Of Accountancy

Salt Tax Increase That Burned Blue States Is Targeted By Democrats The New York Times

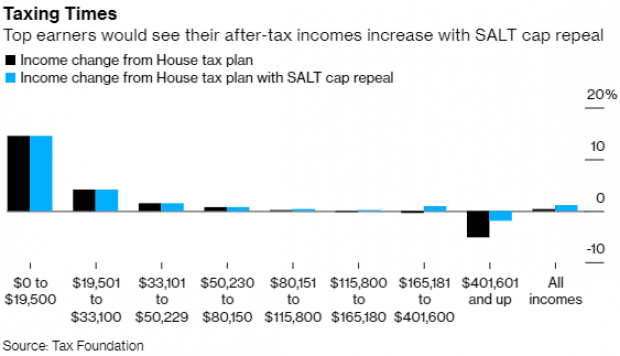

Restoring Salt Deduction Would Slash Dems Tax Hikes For Top Earners Report

What Is Salt Tax Deduction Mansion Global

State And Local Tax Salt Deduction Salt Deduction Taxedu

Unlock State Local Tax Deductions With A Salt Cap Workaround Green Trader Tax

/GettyImages-56970357-5867cc515f9b586e02191b68.jpg)